An In-Depth Analysis of Larimar Therapeutics (NASDAQ: LRMR): A High-Risk, High-Reward Venture into Friedreich's Ataxia

Larimar Therapeutics is a clinical-stage biotech company focused on developing nomlabofusp (CTI-1601), a protein replacement therapy for Friedreich's ataxia (FA), a rare neurodegenerative disease. The investment thesis presents a high-risk, high-reward opportunity centered on this single asset. The bull case highlights nomlabofusp's unique mechanism targeting the root cause of FA by restoring frataxin levels, supported by promising Phase 1/2 data showing dose-dependent increases in frataxin. Regulatory de-risking, including the FDA's removal of a clinical hold and acceptance of frataxin as a surrogate endpoint, strengthens the path to potential accelerated approval. However, significant risks persist: Larimar is pre-revenue with a tight cash runway into late 2026, faces competition from Biogen's approved therapy SKYCLARYS, and relies on upcoming clinical data readouts. The recommendation is a speculative buy for risk-tolerant investors, emphasizing the potential for substantial returns if successful but acknowledging the possibility of total capital loss.

Sarepta Therapeutics (SRPT): An Investment Analysis at the Precipice of Crisis and Opportunity

Sarepta Therapeutics, a leader in precision genetic medicine, faces an existential crisis in 2025 due to patient deaths linked to its flagship gene therapy, ELEVIDYS, triggering severe FDA regulatory actions and a sharp market decline. Despite this, the company maintains a durable revenue base from its RNA-based PMO therapies, which accounted for 54% of 2024 net product revenue. Financially, Sarepta reported record Q2 2025 results, but its valuation has collapsed, pricing in worst-case scenarios. In response, management has initiated restructuring, preserved capital, and pivoted strategically through a partnership with Arrowhead Pharmaceuticals to access siRNA technology. The investment thesis presents a high-risk, binary opportunity: potential multi-fold returns if ELEVIDYS is salvaged and the new platform succeeds, versus significant capital loss if regulatory and safety issues prove insurmountable. This speculative proposition is suited only for risk-tolerant, long-term investors.

An Investment Analysis of Trevi Therapeutics, Inc. (TRVI)

Trevi Therapeutics (TRVI) is a clinical-stage biopharmaceutical company focused on developing its sole asset, Haduvio (oral nalbuphine ER), as a first-in-class treatment for chronic cough in Idiopathic Pulmonary Fibrosis (IPF) and Refractory Chronic Cough (RCC)—conditions with no approved therapies in the U.S. The drug demonstrated strong efficacy in Phase 2 trials (CORAL for IPF and RIVER for RCC), showing significant cough reduction and a manageable safety profile. With a cash runway extending into 2029 following a recent $115 million financing, the company is well-positioned to advance into Phase 3 trials starting in H1 2026. Despite promising clinical and financial de-risking, investment carries significant risks due to its single-asset focus, potential Phase 3 failure, and commercialization challenges. A "Buy" recommendation is advised for high-risk, long-term investors, given the asymmetric upside potential.

An In-Depth Investment Analysis of ALT5 Sigma Corporation (ALTS)

ALT5 Sigma Corp. (ALTS) is undergoing a radical transformation from a dual-mandate biotech and fintech firm into a pure-play Crypto-as-a-Service (CaaS) provider. The company exhibits explosive revenue growth (194% YoY) but faces severe financial losses, extreme cash burn, and massive shareholder dilution due to a recent 1.5billionfinancinground.AstrategicpartnershipwithWorldLibertyFinancial(WLFI) provides capital and high-profile leadership but introduces significant concentration and governance risks. Additionally, reports of an SEC investigation and regulatory uncertainties pose critical threats. The investment is highly speculative, offering potential for multi-bagger returns but also a near-total loss of capital, suitable only for risk-tolerant investors familiar with digital assets. Recommendation: SPECULATIVE BUY with minimal allocation.

An Investment Analysis of Agios Pharmaceuticals (AGIO): A Financially Fortified Biotech at a Clinical Inflection Point

Agios Pharmaceuticals (AGIO) presents a compelling investment opportunity driven by a strong financial position with $1.3 billion in cash, a validated lead drug PYRUKYND® (mitapivat), and key near-term catalysts. The FDA decision on its thalassemia application by September 7, 2025, and Phase 3 sickle cell disease data by year-end 2025 could significantly expand its market potential. Despite risks from regulatory or clinical setbacks and intense competition, the company's robust balance sheet provides a safety net. With a favorable risk/reward profile and analyst consensus supporting upside, AGIO is recommended as a BUY for long-term, growth-oriented investors.

An In-Depth Investment Analysis of Invivyd, Inc. (NASDAQ: IVVD): A High-Stakes Play on the Future of Infectious Disease Prevention

Invivyd, Inc. (IVVD) represents a high-risk, high-reward investment opportunity centered on its next-generation monoclonal antibody, VYD2311, which has secured an accelerated FDA approval pathway. While the company’s proprietary INVYMAB™ platform shows scientific promise for rapidly addressing viral evolution, it faces severe financial challenges, including a high cash burn rate, recent dilutive financing, and significant institutional divestment. Revenue from its commercialized product, PEMGARDA®, remains insufficient to ensure sustainability. The investment thesis is binary: success of VYD2311 could drive substantial valuation upside, while clinical or regulatory failure poses existential risk. Recommended only for risk-tolerant investors with capacity for potential total loss, active monitoring of key catalysts is essential.

GigaCloud Technology Inc. (GCT): An Analysis of a Deeply Undervalued E-commerce Disruptor with Elevated Risks

GigaCloud Technology Inc. (GCT) presents a compelling but high-risk investment opportunity. The company operates an innovative B2B e-commerce platform specializing in large-parcel goods, utilizing its proprietary Supplier Fulfilled Retailing® model to streamline logistics. It demonstrates strong financials with consistent revenue growth, high profitability, and a debt-free balance sheet supported by significant cash reserves. However, the stock trades at a steep valuation discount due to serious short-seller allegations of fraudulent activities and substantial geopolitical exposure tied to its reliance on Chinese manufacturing. Given these binary risks, the analysis recommends a Speculative Buy for risk-tolerant, long-term investors, as a resolution in the company’s favor could trigger significant valuation upside.

KALA BIO (NASDAQ: KALA): An In-Depth Analysis of a High-Stakes Clinical Catalyst in Rare Ophthalmic Disease

KALA BIO, Inc. (NASDAQ: KALA) is a clinical-stage biopharmaceutical company whose investment potential hinges entirely on the success of its lead candidate, KPI-012, for treating Persistent Corneal Epithelial Defect (PCED). The company has strategically repositioned itself as a pure R&D entity after divesting its commercial assets, focusing all resources on its Mesenchymal Stem Cell Secretome (MSC-S) platform. The critical catalyst is the topline data from the Phase 2b CHASE trial, expected by the end of September 2025. A positive outcome could validate the platform and unlock a significant market with no approved therapies, while failure would severely impact the company's valuation. Financially, KALA is pre-revenue with a history of losses and shareholder dilution. Despite sufficient cash to fund operations into Q1 2026, a successful trial would necessitate immediate capital raising for further development. The investment is rated as a Speculative Buy, suitable only for high-risk investors aligned with the binary nature of the upcoming clinical results.

Pliant Therapeutics (PLRX): An Investment Analysis at the Crossroads of Failure and a High-Stakes Pivot

Pliant Therapeutics has undergone a fundamental transformation following the failure of its lead asset, bexotegrast, in a Phase 2b/3 trial for idiopathic pulmonary fibrosis (IPF). This event erased most of the company's value, shifting its focus to an early-stage oncology asset, PLN-101095. Interim Phase 1 data for this drug showed a promising 50% response rate in a small cohort, positioning it as the primary near-term value driver. The company maintains a strong cash position, providing a multi-year operational runway. However, the investment is now a high-risk bet on this single asset, with the upcoming late-2025 data readout serving as a critical binary catalyst. The current market valuation, trading near or below net cash, offers asymmetric upside potential but is suited only for speculative, risk-tolerant investors.

X4 Pharmaceuticals (XFOR): An In-Depth Analysis of a High-Stakes Hematology Turnaround

This report recommends a Speculative Buy for X4 Pharmaceuticals (XFOR), a clinical-stage biotech company whose value hinges on the success of its lead drug, mavorixafor. The investment thesis centers on a recent strategic overhaul, including new leadership with a proven track record from CTI BioPharma and an $85 million financing that extended the cash runway into H1 2026. The company is focused exclusively on advancing mavorixafor, which is already approved for the ultra-rare WHIM syndrome but targets the much larger Chronic Neutropenia (CN) market. The pivotal Phase 3 4WARD trial in CN, with top-line data expected in H2 2026, represents a binary event for the company’s valuation. Key risks include clinical trial failure, high cash burn requiring future dilutive financing, and commercial challenges in a competitive market. The recommendation is suitable only for risk-tolerant, long-term investors capable of withstanding potential total loss.

Taysha Gene Therapies (TSHA): An In-Depth Analysis of a High-Stakes Gene Therapy Investment

Based on a comprehensive investment thesis, Taysha Gene Therapies (TSHA) presents a high-risk, high-reward opportunity centered on its lead gene therapy, TSHA-102, for Rett syndrome. The bull case is supported by highly promising early clinical data showing a 100% response rate and a favorable safety profile, a novel self-regulating technology (miRARE) that solves a key biological challenge, a significant competitive advantage after a rival's safety setback, a strong balance sheet with cash into 2028, and a clear regulatory pathway. The primary risk is the binary outcome of its pivotal trial, as the company's value is entirely dependent on this single asset. Despite the potential for substantial upside, the investment is speculative and recommended only for risk-tolerant investors with a long-term horizon

Structure Therapeutics (GPCR): An In-Depth Analysis of a High-Stakes Contender in the Oral Obesity Market

Based on a comprehensive analysis, Structure Therapeutics (GPCR) represents a high-risk, high-reward investment opportunity entirely dependent on the outcome of its lead drug, aleniglipron. This oral small-molecule GLP-1 agonist for obesity is set to report critical Phase 2b trial data by year-end 2025. The company is targeting a massive and growing anti-obesity market, projected to exceed $100 billion, where its small-molecule approach offers potential manufacturing advantages. However, GPCR operates in an intensely competitive landscape. Recent data from rivals like Eli Lilly, Novo Nordisk, and Viking Therapeutics have set a formidable efficacy benchmark. For aleniglipron to succeed, its data must be competitive on both weight loss and tolerability. Financially, the company is well-capitalized with cash into 2027, though significant future dilution is expected to fund Phase 3 trials. The stock is characterized by a stark disconnect between bullish analyst price targets (suggesting over 200% upside) and a market price that implies deep skepticism, reflected in high short interest. Consequently, an investment in GPCR is a speculative, binary bet on the success of its upcoming clinical data, suitable only for sophisticated, risk-tolerant investors who can withstand potential total capital loss.

Super Group (SGHC): An In-Depth Investment Analysis of a Global Gaming Powerhouse

Super Group (SGHC) Limited is a global digital holding company specializing in online sports betting and iGaming, operating through its dual-brand strategy with Betway (sports betting) and Spin (online casino). The company went public on the NYSE in 2022 via a SPAC merger. SGHC has demonstrated strong financial performance, with record Q2 2025 revenue of 579.4million(up30156.7 million (up 78% YoY), driven significantly by its dominant position in the high-growth African market, which now accounts for 40% of total revenue. The company maintains a debt-free balance sheet with $393 million in cash and has implemented a shareholder-friendly capital return program, including an increased dividend. SGHC is rated a Buy with a $15.50 price target, based on its profitable growth strategy, competitive moat in key markets like Africa, and attractive valuation discount compared to peers like Flutter Entertainment and DraftKings. Key risks include regulatory challenges, intense competition, and geographic concentration in emerging markets. The company is positioned as a compelling investment for growth-at-a-reasonable-price (GARP) investors seeking exposure to the global iGaming sector.

Comprehensive Investment Analysis of Centuri Holdings, Inc. (NYSE: CTRI)

Centuri Holdings, Inc. (NYSE: CTRI) is a newly independent utility infrastructure services company that offers investors exposure to long-term trends in North American grid modernization and the energy transition. The company benefits from strong secular tailwinds, including aging infrastructure, renewable energy adoption, and government funding, supported by a record $5.3 billion backlog and a robust sales pipeline. However, Centuri faces significant near-term risks, including high leverage, lack of profitability, and ongoing share sales by its former parent, Southwest Gas Holdings. While its growth-adjusted valuation appears attractive (PEG ratio < 1.0), the investment case hinges on management’s ability to improve margins and reduce debt. It is recommended for risk-tolerant, long-term investors, while conservative investors should await proof of sustainable profitability and reduced financial risks.

An In-Depth Investment Analysis of CG Oncology (CGON): Assessing a Potential New Standard of Care in Non-Muscle Invasive Bladder Cancer

CG Oncology is a clinical-stage biopharmaceutical company focused on developing cretostimogene grenadenorepvec, an intravesical oncolytic immunotherapy for non-muscle invasive bladder cancer (NMIBC). Its pivotal Phase 3 BOND-003 trial demonstrated strong efficacy with a 75.5% complete response rate and unprecedented durability (median duration of response >28 months), alongside an excellent safety profile featuring no Grade 3+ treatment-related adverse events. The drug holds a competitive edge due to its local administration, independence from BCG supply, and superior risk-benefit profile compared to systemic alternatives like Keytruda. With a robust cash position of $661.1 million extending into H1 2028, the company is well-funded to pursue regulatory approval and commercial launch. Despite inherent clinical-stage risks, analysts view CGON as a speculative buy given its multi-billion-dollar market opportunity and compelling clinical data

An In-Depth Investment Analysis of Olema Pharmaceuticals (NASDAQ: OLMA) - Pioneering a New Endocrine Backbone in Breast Cancer

Olema Pharmaceuticals is a clinical-stage biopharmaceutical company focused on developing therapies for women's cancers, with its lead candidate, palazestrant (OP-1250), targeting ER+/HER2- breast cancer. Palazestrant features a dual mechanism of action as both a complete estrogen receptor antagonist (CERAN) and a selective estrogen receptor degrader (SERD), designed to overcome resistance seen with current endocrine therapies. Early clinical data has shown promising efficacy and safety, supporting its advancement into two pivotal Phase 3 trials: OPERA-01 (monotherapy) and OPERA-02 (combination therapy). The company has secured strategic collaborations with Pfizer and Novartis, validating its approach and positioning palazestrant as a potential partner for CDK4/6 inhibitors. However, Olema faces significant risks, including its heavy reliance on the success of palazestrant, intense competition from larger pharmaceutical companies, and a high cash burn rate with financial runway extending only into 2026. While analyst consensus is bullish, the investment remains highly speculative, suitable only for risk-tolerant investors with a long-term horizon. Key catalysts include the initiation of OPERA-02 and the critical top-line data from OPERA-01 expected in late 2026.

An Investment Analysis of Nurix Therapeutics, Inc. (NRIX)

Nurix Therapeutics (NRIX) is a clinical-stage biopharmaceutical company focused on targeted protein degradation (TPD), presenting a high-risk, high-reward investment opportunity. The company’s lead asset, bexobrutideg (NX-5948), has demonstrated strong efficacy in B-cell malignancies with an 80.9% objective response rate in CLL and a favorable safety profile. Nurix’s proprietary DEL-AI platform, validated through partnerships with Gilead, Sanofi, and Pfizer, supports its drug discovery efforts. With approximately $486 million in cash, the company is well-funded to advance pivotal trials. However, the investment is speculative, heavily dependent on clinical success, and faces competition and financial risks. A Speculative Buy rating is recommended for risk-tolerant, long-term investors.

LENZ Therapeutics (NASDAQ: LENZ): An In-Depth Investment Analysis on the Commercialization of VIZZ

LENZ Therapeutics (LENZ) offers a high-risk/high-reward investment centered on VIZZ™, its FDA-approved eye drop for presbyopia (age-related near vision loss). VIZZ™'s "ciliary-sparing" mechanism provides up to 10 hours of improved near vision without the distance-blurring side effects of competitor VUITY®, targeting a vast U.S. market of approximately 128 million people. With $209.6M cash funding its U.S. launch through profitability and strong institutional backing (average target $92.50), investors are betting on blockbuster potential post–Q4 2025 launch.

Rigel Pharmaceuticals (RIGL): An Undervalued Commercial Biotech at a Profitability Inflection Point

Rigel Pharmaceuticals (RIGL) presents a compelling investment opportunity as it transitions from R&D to a profitable commercial biotech. Its diversified portfolio—TAVALISSE (ITP), REZLIDHIA (AML), and GAVRETO (NSCLC)—drove 2025 revenue guidance upward to $270-280M and sustained profitability. The pipeline asset R289 (Phase 1b IRAK1/4 inhibitor for LR-MDS) represents significant upside as a "free call option," with catalysts including 2025 data readouts. A Sum-of-the-Parts valuation yields a $38 price target (74% upside), supported by commercial execution, patent protection through 2032-2041, and strong cash flow to self-fund growth. Risks include clinical setbacks and competition. Recommendation: BUY.

Match Group, Inc. (MTCH): Is the Turnaround Coming?

Match Group faces stagnant revenue amid a 5% payer decline offset by RPP growth. Hinge surges 25% YoY as the growth engine, while Tinder struggles with user attrition. New CEO Spencer Rascoff's 3-phase AI-driven turnaround strategy ("Reset, Revitalize, Resurgence") aims to revive Tinder and culture. Despite strong cash flow and aggressive buybacks signaling undervaluation, significant execution risk, competitive pressures, and a major shareholder lawsuit alleging safety failures threaten the thesis. A speculative BUY is recommended for high-risk investors, contingent on Tinder stabilization and Hinge's sustained momentum.

BioCryst Pharmaceuticals (BCRX): An In-Depth Investment Analysis at the Inflection Point of Profitability

BioCryst Pharmaceuticals (BCRX) has achieved a critical inflection point, transitioning to profitability driven by its oral HAE drug ORLADEYO® (156.8MQ22025revenue,+45249M debt, projecting 700M cash by 2027. The companyt argets 1B peak sales for ORLADEYO, supported by pediatric expansion (PDUFA Dec 2025) and strong U.S. growth. Pipeline catalysts include Phase 1 data for BCX17725 (Netherton Syndrome) and Avoralstat (Diabetic Macular Edema) by end-2025. Trading at 3.3x P/S with 95% analyst "Buy" ratings, BCRX presents compelling upside as a debt-free rare disease platform leveraging its commercial engine for consolidation.

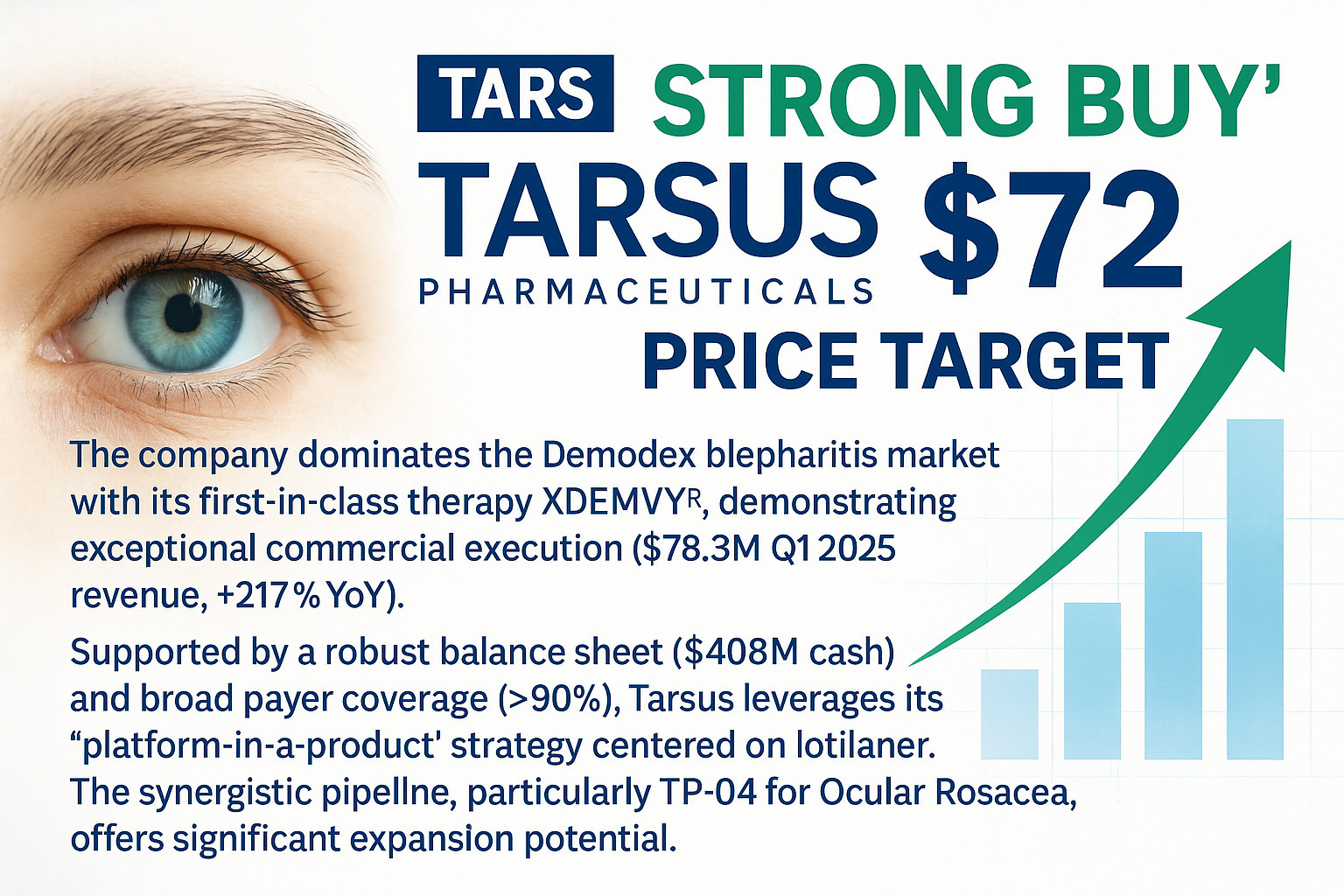

Tarsus Pharmaceuticals (NASDAQ: TARS) - Building a First-in-Class Ophthalmic Franchise

Tarsus Pharmaceuticals (TARS) presents a strong "Buy" opportunity with a $72 price target. The company dominates the Demodex blepharitis market with its first-in-class therapy XDEMVY®, demonstrating exceptional commercial execution ($78.3M Q1 2025 revenue, +217% YoY). Supported by a robust balance sheet ($408M cash) and broad payer coverage (>90%), Tarsus leverages its "platform-in-a-product" strategy centered on lotilaner. The synergistic pipeline, particularly TP-04 for Ocular Rosacea, offers significant expansion potential.

Celcuity Inc. (CELC): An In-Depth Analysis of a Paradigm-Shifting Oncology Asset

Celcuity Inc. (CELC) presents a high-risk, high-reward investment opportunity driven by its lead asset, gedatolisib. This pan-PI3K/mTOR inhibitor demonstrated unprecedented efficacy in the Phase 3 VIKTORIA-1 trial for PIK3CA wild-type HR+/HER2- advanced breast cancer, showing a 76% reduction in progression risk and 7.3-month PFS improvement. The transformative data triggered a stock surge and enabled a strategic $248.7 million capital raise, extending the cash runway through key catalysts. While the IV administration route and single-asset dependency pose significant commercial and clinical risks, the potential for gedatolisib to become a new standard of care in a multi-billion dollar market supports a Speculative Buy recommendation.

Hims & Hers Health, Inc. (HIMS): An Investment Analysis of a High-Growth, High-Risk Disruptor

Hims & Hers Health (HIMS) is a high-growth telehealth disruptor leveraging a vertically integrated DTC model to address stigmatized health conditions. It demonstrates explosive revenue growth (111% YoY in Q1 2025), 2.4 million subscribers, and strong profitability. Its "personalization flywheel" – using proprietary data/AI to tailor treatments – drives retention and creates a competitive moat. Expansion into weight loss, menopause, low testosterone, and international markets (via ZAVA acquisition) fuels the bull case. However, existential risks loom: heavy reliance on legally precarious compounded GLP-1 drugs triggered regulatory scrutiny, a severed Novo Nordisk partnership, shareholder lawsuits, and a 30% stock plunge. While operational execution is impressive, severe regulatory/legal overhangs create a binary risk profile. Recommendation: Hold with a $45 price target, reflecting balanced risk/reward amid uncertainty.

AI Meets Credit: Why Pagaya (PGY) Trades Below Its True Worth

Pagaya Technologies (PGY) presents a compelling buy opportunity at its profitability inflection point. Recent GAAP profitability (Q1 2025), accelerating earnings (preliminary Q2 2025), and a capital-light B2B2C model secured by $5B in forward-flow funding create resilient growth. Despite macroeconomic sensitivity and high volatility, Pagaya trades at a significant discount to peers (e.g., 1.66x P/S vs. Upstart's 9.83x) while demonstrating superior near-term profitability. Initiated with a **BUY** rating and $32.00 price target for 12-18 months.

VEON Ltd. ($VEON): Banking on Ukraine’s Digital Rebuild

VEON Ltd. (NASDAQ: VEON) presents a high-risk, high-reward opportunity following its strategic exit from Russia and pivot to frontier markets. Trading at a deep discount to intrinsic value, the company offers compelling valuation metrics (forward P/E ~7.8x, EV/EBITDA 3.52x) alongside strong digital revenue growth (+50% YoY) and a transformed balance sheet (net debt/EBITDA 1.23x). Key catalysts include the planned 2025 Nasdaq listing of its Ukrainian crown jewel Kyivstar and potential dividend reinstatement. However, severe geopolitical risks in Ukraine, Pakistan, and Bangladesh, plus structural FX headwinds, warrant caution. Recommended as a Speculative Buy exclusively for investors with high risk tolerance and long-term horizons.

Levi's ($LEVI) is Taking off

Levi Strauss & Co. (NYSE: LEVI) appears attractive at a $25 price target, supported by its ongoing shift to a higher-margin, DTC-led model. Q2 FY 2025 was an inflection point: gross margin reached a record 62.6 %, and EPS of $0.22 beat the $0.13 consensus, powered by DTC revenue rising above 50 % of total sales. Management also authorized an additional $100 million share-repurchase program. Trading at 24.6 × forward P/E with 28 % ROE, the valuation looks reasonable given structurally expanding margins. Key risks: sensitivity to consumer discretionary spending and the inherent cyclicality of fashion trends. Sources Ask ChatGPT

Why KalVista Pharmaceuticals ($KALV) Could Deliver a 3× Return Within a Year

KalVista Pharmaceuticals (KALV) is a biopharmaceutical company whose core asset is EKTERLY®, the first FDA-approved oral, on-demand treatment for HAE. With its convenience, the drug is poised to disrupt the market and is the primary value driver. The company’s oral prophylactic drug in development offers long-term growth potential. Although the company faces risks from commercialization, fierce competition, and financial losses, this analysis views KALV as a high-risk, high-reward investment opportunity and assigns it a "Buy" rating.

Betting on Nebius ($NBIS): The Anatomy of a Potential 10-Bagger

Nebius Group (NBIS) is a high-risk, high-reward AI infrastructure "Neocloud" provider spun out of Yandex. Its investment appeal stems from explosive revenue growth, a strategic partnership granting early access to NVIDIA's latest GPUs, and a strong, debt-free balance sheet. This vertically integrated model promises cost and performance advantages. However, NBIS is currently unprofitable with significant cash burn. It faces fierce competition from tech giants and a direct rival, CoreWeave, while carrying a lofty valuation. Suitable only for long-term investors with high-risk tolerance, the company's success hinges on executing its ambitious expansion and achieving profitability.

CoreWeave-Core Scientific Merger and Its Implication on the Valuation of Iris Energy ($IREN)

The 9 billion CoreWeave−CoreScientific merger validates Bitcoin miners′ strategic pivot to AI infrastructure, establishing power capacity a sakey valuation metric (5-7M/MW). Core Scientific's dependency led to acquisition, while Iris Energy (IREN) pursues independent growth with superior fundamentals: minimal debt, positive cash flow, and industry-leading 15 J/TH mining efficiency. IREN's secured 2.9GW power pipeline dwarfs peers, enabling multi-tenant AI expansion. Sum-of-parts valuation indicates significant undervaluation versus its $4.05B market cap. With 100% renewable-powered infrastructure and proven execution, IREN represents a premier investment for AI infrastructure growth, positioned for organic expansion or strategic acquisition.

Vor Biopharma ($VOR): Putting Every Chip on Telitacicept

Vor Biopharma (NASDAQ: VOR) pivoted from oncology to autoimmunity in June 2025 after near-bankruptcy. The company secured exclusive global rights (excluding China) to RemeGen's Phase 3 drug telitacicept and raised $175 million through a PIPE financing. Post-transaction, VOR focuses solely on advancing telitacicept for generalized myasthenia gravis (gMG), leveraging its strong China Phase 3 data. New CEO Dr. Jean-Paul Kress leads execution. Key risks include massive dilution from 700M+ new warrants, a cash runway extending only to late 2026/early 2027 ahead of pivotal 2027 data, and operational constraints with 8 remaining employees. Prior oncology assets (trem-cel, VCAR33) were discontinued.

Oscar Health, Inc. (OSCR): An Analysis of a High-Stakes Turnaround Story

Oscar Health (OSCR) presents a high-risk investment opportunity following its recent turnaround to profitability under CEO Mark Bertolini. While demonstrating strong revenue growth (42.2% YoY), improved operational efficiency, and positive cash flow, the insurtech faces existential regulatory risks tied to Affordable Care Act subsidies and policy stability. Despite its innovative technology platform and 2 million members, analyst downgrades, significant insider selling, fierce competition from insurance giants, and extreme stock volatility (Beta 1.90) create "asymmetric downside risk." The stock is suitable only for aggressive, long-term investors tolerant of policy-driven volatility, while conservative investors should avoid due to uncontrollable external threats.

Why the SEC Dismantled the Case Against Payment for Order Flow in 2025

Under new Chairman Paul Atkins, the SEC reversed its stance on banning Payment for Order Flow (PFOF) in 2025. The decisive June 12 withdrawal of 14 Gensler-era rule proposals—including the cornerstone Order Competition Rule and Regulation Best Execution—eliminated all pathways to prohibit PFOF. This reflects Atkins' regulatory philosophy emphasizing capital formation, reduced burdens, and market-led solutions over structural intervention. PFOF will remain legal, governed by existing disclosure rules (605/606) and FINRA's best execution standard. The U.S. now diverges from major jurisdictions like the UK and EU that banned PFOF, preserving the zero-commission trading model underpinning retail brokerage economics while maintaining off-exchange execution.

AeroVironment, Inc. (AVAV): An In-Depth Analysis of a High-Stakes Transformation in Defense Technology

AeroVironment is rapidly evolving from a niche drone maker into an all-domain defense-tech leader through its $4.1 billion acquisition of BlueHalo. Surging global defense budgets, demand for autonomous and Counter-UAS systems, and a record $727 million backlog underpin strong long-term growth potential. Yet the deal adds $925 million of debt and will be followed by a $1.35 billion equity/convertible raise, creating dilution and execution risk. Trading near 180× earnings, the stock is priced for flawless integration and sustained double-digit growth. AVAV is a Speculative Buy for risk-tolerant investors, best accumulated on pullbacks.

Howmet Aerospace (HWM): A Best-in-Class Operator in a Secular Bull Market

Howmet Aerospace (HWM) is positioned as a premier pure-play beneficiary of the commercial aerospace super-cycle, leveraging its technological leadership in mission-critical components. Post-2020 spin-off, the company exhibits exceptional execution: 12% 2024 revenue growth, 480bps EBITDA margin expansion, and $977M free cash flow. Key strengths include dominant market share in non-discretionary engine/airframe components, accelerated high-margin aftermarket growth (17% of revenue), and disciplined capital allocation driving debt reduction (1.4x Net Debt/EBITDA) and buybacks. While secular aerospace tailwinds, defense growth (+15%), and data center-driven IGT demand underpin long-term prospects, the current ~60x P/E valuation poses significant risk. Recommended as a "Buy" for risk-tolerant investors seeking aerospace exposure, with caution for near-term volatility.

The Reddit Anomaly: Deconstructing the Drivers of Community-Centric Growth in the Algorithmic Age

Reddit's anomalous growth in the algorithmic social media era stems from its unique community-centric architecture, strategic catalysts, and user migration from mainstream platforms. Its decentralized "community-as-content" model, powered by volunteer moderators and anonymity, generates unparalleled authenticity and niche expertise – a valuable commodity against AI-generated noise. This inherent strength was amplified by winning Google's algorithm through SEO, monetizing data for AI training, modernizing its app/video experience, and its IPO. Simultaneously, user fatigue with invasive data practices, algorithmic feeds, and toxic environments on rivals pushed users toward Reddit's authentic discourse. The critical challenge is balancing aggressive monetization (advertising, data licensing) with sustaining the volunteer communities that create its core value.

Micron Rides the AI Memory Wave—Supercycle Profits Ahead?

Micron Technology (MU) is uniquely positioned to capitalize on the AI-driven memory supercycle. As the sole U.S.-based memory manufacturer, it benefits strategically from government support like the CHIPS Act. Micron’s technological leadership, particularly in high-margin High-Bandwidth Memory (HBM) critical for AI accelerators, is driving a structural shift toward higher, more stable profitability. Strong execution has led to sold-out HBM capacity and record data center revenue, with fiscal 2025 poised for record corporate results. Despite cyclical market risks and intense competition, Micron’s forward valuation appears attractive relative to its enhanced earnings potential. We recommend BUY with a 12-18 month price target of $180.00.

Investment Analysis: Constellation Energy Corporation (NASDAQ: CEG)

Constellation Energy (CEG) dominates U.S. carbon-free energy production (10% national output), leveraging its nuclear fleet and strategic initiatives like the Calpine acquisition and Crane nuclear plant restart to capitalize on surging electricity demand from data centers and EVs. Despite a premium valuation (P/E ~32x vs. industry 18x), its robust operational efficiency (94.6% nuclear capacity), strong financials (upgraded credit rating), and shareholder returns (25% dividend hike) justify a Buy rating for long-term investors. Key risks include regulatory shifts and execution challenges.

Assessment of Robinhood (HOOD) Current Valuation

Robinhood (HOOD) demonstrates strong recovery with $69.28B market cap, driven by diversified revenue (notably crypto +100% YoY), user growth (25.9M funded customers), and improved profitability (P/E 42.42, below historical avg). While regulatory risks (PFOF scrutiny, crypto volatility) and competition persist, its strategic expansion into banking, prediction markets, and international services supports a reasonable valuation for long-term investors.

Investing in China’s Biotech Rise: BeiGene (ONC) and the Future of BeOne Medicines

BeiGene (soon BeOne Medicines) has achieved GAAP profitability in Q1 2025, driven by strong sales of BRUKINSA (792M,+62171M). The company's strategic redomiciliation to Switzerland and recent patent victory bolster its global oncology position. With a robust pipeline (17 Phase 3 trials) and 4.9B−5.3B revenue guidance, BeiGene presents a compelling investment case. Analysts recommend "Buy" given its growth trajectory and profitability.

Can UnitedHealth Group (UNH) Turn around?

UnitedHealth Group (UNH), the largest U.S. health insurer, faces significant headwinds including regulatory scrutiny (CMS V28 rule, DOJ investigations), a major cyberattack impact (~2.9Bcost),andrisingmedicalcosts,causingitsstocktoplummet5025M in shares), UNH presents a compelling long-term BUY opportunity for investors tolerant of near-term regulatory/operational risks.

The Future of Robinhood (HOOD): Navigating Disruption, Regulation, and a Triumvirate of Competitors

Robinhood (HOOD) presents a high-risk, high-reward opportunity as it pivots from a trading app to a diversified "financial superapp." Q1 2025 showed explosive growth (50% revenue increase, 114% net income surge), driven by crypto/options trading and its Gold subscription service. However, its core revenue model relies heavily on Payment for Order Flow (PFOF), facing existential SEC regulatory threats. Compared to stable Charles Schwab (diversified revenue, $9.93T assets) and volatile Coinbase (crypto-centric, SEC lawsuit risk), HOOD trades at premium multiples (20x P/S) but carries unique execution and regulatory risks. Suitable only for long-term investors with high volatility tolerance, pending PFOF clarity and successful M&A integration (Bitstamp, TradePMR).

Is it the Right Time to Buy GOOG?

Alphabet’s strong fundamentals—robust ad growth (Search + YouTube +12% YoY), accelerating cloud profitability (12.3Brevenue,+2875B in 2025) targets AI/cloud demand. Despite regulatory/antitrust risks (U.S., EU, Turkey) and competition (AWS/Azure), valuation remains compelling: PE 18.4x (vs. 10-yr avg 28.1x and peer Meta/MSFT 26-37x). Analysts see 20.8% upside (avg target $201). Use short-term dips for entry.

Microvast Holdings (MVST): An In-Depth Investment Analysis of a Niche Battery Innovator at a Crossroads

This report provides an in-depth analysis of Microvast Holdings (MVST), a niche lithium-ion battery manufacturer, recommending a "Speculative Buy" for high-risk, long-term investors. The bullish case highlights Microvast's recent achievement of profitability in Q1 2025, driven by superior gross margins (36.9%) and a technological moat centered on its high-safety polyaramid separator. A key partnership with General Motors validates its technology. However, the bearish view points to substantial risks, including a stalled U.S. factory due to funding shortfalls, intense competition from industry giants, a history of net losses, and significant geopolitical exposure from its operations in China.

IREN Limited (NASDAQ: IREN): Powering the Convergence of Bitcoin and AI — An Infrastructure-First Investment Thesis

IREN Limited (IREN) is a compelling buy opportunity due to its undervalued digital infrastructure, not just Bitcoin mining. Its core asset is a massive, low-cost, renewable power pipeline (>2.9GW secured), forming a critical competitive moat in the power-constrained AI era. IREN strategically monetizes this via two high-growth channels: 1) Best-in-class, profitable Bitcoin mining (50 EH/s target) and 2) A rapid pivot to high-margin AI/HPC data centers (50MW Horizon 1 under construction). This dual-engine model leverages infrastructure to tap into massive Bitcoin and AI secular trends, de-risking the business. Despite achieving profitability and securing full near-term funding (550M),the market undervalues IREN's infrastructure and AI potential. Initiate coverage with a BUY rating.

Project XXI: An In-depth Investment Analysis of Cantor Equity Partners (CEP) and the Dawn of a New Bitcoin-Native Public Company

This report analyzes Cantor Equity Partners' (CEP) transformation into Twenty One Capital (XXI), a new Bitcoin-native public company. Backed by a consortium including Cantor Fitzgerald, SoftBank, and Tether, and led by CEO Jack Mallers, it aims to maximize Bitcoin per share. The investment's core thesis is a high-risk bet on the legitimization of its majority owner, Tether, which faces U.S. federal investigations for alleged large-scale illicit finance. Significant risks also include severe corporate governance flaws disenfranchising public shareholders and major political conflicts of interest. It is a highly speculative vehicle suitable only for sophisticated investors prepared for a total loss.

Circle (CRCL) Post-IPO Analysis: A Fundamental Valuation in the New Era of Publicly Traded Stablecoin Issuers

Following its successful June 2025 IPO, stablecoin issuer Circle (CRCL) reached a valuation exceeding $18 billion. The company's revenue is overwhelmingly generated from interest on its USDC reserves, creating significant exposure to interest rate fluctuations. A comparative analysis reveals that unlike large U.S. banks with diversified income and mature risk management, Circle's business model is highly concentrated. While the company is expanding into payments and API services, these segments are not yet significant contributors. The lofty valuation reflects market optimism for its future in digital payments, but its success hinges on diversifying revenue beyond interest income to ensure sustained profitability.

Roblox (RBLX): Analyzing the Surge and Assessing the Path to Sustained Growth

Roblox's recent stock surge stems from a strong Q1 2025 earnings report that showcased accelerating revenue, cash flow, and user engagement. The company is transitioning from a growth-at-all-costs model to profitable growth, driven by four strategic pillars: aging up the user base, global expansion, a booming creator economy, and new monetization via e-commerce and ads. While long-term prospects are compelling, risks remain, including regulatory scrutiny, insider selling, and execution challenges. Sustained momentum hinges on Roblox's ability to deliver consistent financial performance and strategic execution.